Why Dublin

Forbes magazine has ranked Ireland as one of the best countries for business. This is not just for large multinationals, but also the potential multinationals of the future. IDA nurtures these high-growth companies, helping them forge their future success in Ireland.

Economy

The Irish economy is the fastest growing in the Eurozone and the 6th most competitive in the world.

Outlook

- Ireland is a stable, competitive, secure and pro-business country

- Ireland is part of the EU single market and a member of the eurozone

- Ireland has a highly skilled, eucated, young and multicultural population

Export markets

Ireland’s exports grew by 6.1% year on year from 2015 to 2016. Overseas companies continue to be significant exporters from Ireland, with IDA clients accounting for 66% of national exports. The country’s main markets are the EU and the USA, and the main exporting sectors are:

- Pharmaceuticals & Chemicals

- Computer services

- Business services

- Financial services & Insurance

- Food & Beverages

- Medical devices

Demographics

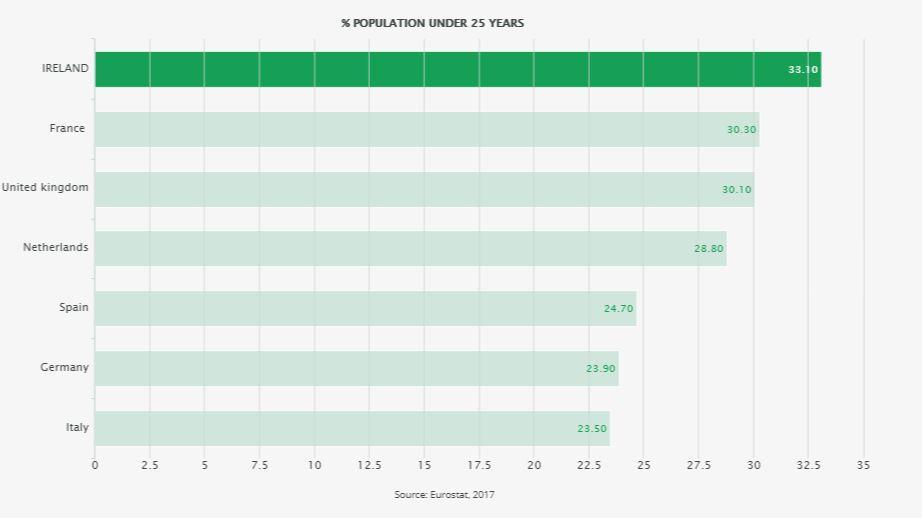

Ireland’s young workforce is capable, highly adaptable, educated and very committed to achievement. Ireland has the youngest population in Europe with a third of the population under 25 years old and almost half the population under the age of 34.

Education & Skills

There are over one million people currently in full-time education in Ireland. These are engaged in three levels of education: primary education (up to 12 years); secondary education (12-18 years); and third-level education (18+ years).

Ireland ranks in the top ten globally for:

- Quality of the education system

- University education that meets the needs of a competitive economy

- Knowledge transfer between universities and companies.

Government initiatives

There has been significant investment in developing schemes to help boost Ireland’s education and skills base in order to maximise employment opportunities.

Increasing number of Technology Graduates

The Government’s technology skills action plan aims to make Ireland a global leader for technology talent and skills. The target is to meet 74% of forecast industry demand for high-level technology skills from the education system by 2018, up from the current level, estimated at over 60%. In line with industry norms, it is envisaged that remaining demand will be met by continuing to attract highly skilled people from abroad.

This will be achieved through a number of measures one being the issuance of up to 2,000 employment permits per year to experienced technology professionals with skills in high demand. In addition to this through the Tech Life Initiative, the government plan to increase the number of people working in tech in Ireland by 3,000 per year. Log on to www.techlifeireland.com for more information.

Jobs Plus Initiative

The government supported Jobs plus Initiatives encourages and rewards employers who offer employment opportunities to the long-term unemployed. This scheme offers up to €10,000 for a qualifying recruit payable on a monthly basis over a 2 year period. Registration is available online at www.jobsplus.ie.

Springboard Programme

Springboard+ assists job seekers and those in employment or self-employment who wish to upskill/reskill in the Biopharma/Medtech and ICT sectors. Springboard+ 2017 will provide over 6,400 new free education places through 198 courses at public and private educational institutions across Ireland. In 2017, 54% of courses will be delivered on a blended, distance and e-learning basis.

For more Information see www.springboardcourses.ie

Multilingual skills

There are more than 535,000 non-Irish nationals living in Ireland, with persons born abroad accounting for just over 17% of the country’s population. Over 70% of the non-Irish national population came from12 nations – Brazil, France, Germany, India, Italy, Latvia, Lithuania, Poland, Romania,Spain, the UK and the U.S.

In the year to April 2016, inward immigration by foreign nationals to Ireland was 54,203. While companies operating in Ireland have access to a labour pool of almost 400m people from across the EU, they may require people who have some specific talent from outside the EU, who will require employment permits and visas. IDA Ireland works in close consultation with the relevant Irish authorities in this area.

Source: CSO, 2017

The most spoken foreign languages in Ireland are Polish (135,896), French (54,948), Romanian (36,683), Lithuanian (35,362), Spanish (32,405) and German (28,331). Of the 612,018 people who speak a foreign language at home 183,923 are Irish nationals. The most spoken language among those born in Ireland is French, followed by Polish and German.

Source: CSO, 2017

Wages & Salaries

Labour costs

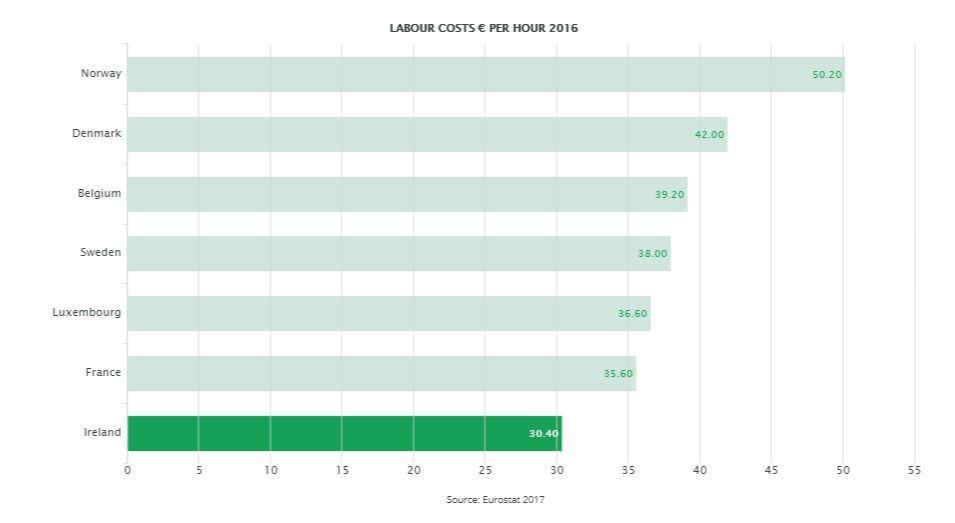

Since 2012 Irish labour costs have remained relatively stable, increasing by 4% compared to an average increase of 6.6% for the Eurozone as a whole.

Cost of living

The cost of housing has decreased with residential rents and house prices down from peak levels. Dublin still ranks extremely well among capital cities in terms of rents, price of services, price of city breaks, hotels, restaurants and clothing.

Competitive gains

- Inflation below the EU average since 2008

- On-going relative competitiveness improvements.

Tax

Corporate tax rates have been one of the principal elements of the favourable enterprise environment in Ireland for more than three decades. The Irish tax regime is open and transparent and complies fully with OECD guidelines and EU competition law.

Ireland's tax regime

The key features of Ireland’s tax regime that make it one of the most attractive global investment locations include:

- 12.5% corporate tax rate - This applies to all Irish corporate trading profits. A rate of 25% applies to non-trading (passive) income.

- 25% R&D tax credit

- Excellent intellectual property (IP) regime

- Attractive holding company regime

- Effective zero tax rate for foreign dividents.

Property

A significant number of new office construction projects are underway.

Key Developments

- C.5.7 million SQ FT (529,547 SQ M) of new office stock will be coming to the Dublin office market over the next 18-24 months.

- 4 million SQ FT (371,612 SQ M) of prime office space is currently under construction in Dublin to be delivered over the next 2 years.

- There is a further C.1.7 million SQ FT (157,935 SQ M) of space under refurbishment which will be delivered to the Dublin office market over the next 18-24 months.

- There is excellent rental value in regional locations outside Dublin.

Infrastructure

Over the past twenty years the Irish Government has implemented successive programmes of infrastructure development and investment. This has helped modernise traditional areas and create new sectors around Ireland’s abundant natural energy capabilities to support Ireland’s economic progress well into the future.

Telecommunications

Ireland has one of the most advanced and competitive telecommunications infrastructures in Europe. The telecommunications market is fully de-regulated and numerous companies have entered the market. Large investments in recent years have resulted in state-of-the-art optical networks with world-class national and international connectivity.

Energy

Energy infrastructure is a critical component in attracting business to Ireland. EirGrid controls the Irish national grid and the development of high voltage infrastructure to serve Ireland's economy. It is currently developing a large number of major transmission projects that will boost Ireland’s already impressive network. Ireland is also taking a lead in promoting the sustainable energy sector. The Irish coastline has an abundance of renewable energy, in the offshore wind and wave sectors. Ireland’s renewable energy strategy is focused on further developing the country’s sustainable energy infrastructure to benefit the economy.

Water

Irish Water is Ireland’s new national water utility that is responsible for providing and developing water services throughout Ireland.

Irish Water’s remit includes bringing the water and wastewater services of the 34 Local Authorities together under one national service provider.

Transport

- Road network - Transport 21 is the €34.4 billion national transport investment programme that is being implemented over the 10-year period from 2006-2015. This strategy has seen a rapid improvement in Ireland’s road and motorway network to promote sustainable national economic and employment growth while strengthening Ireland’s international competitiveness

- Rail network - In the past decade, infrastructural improvements have been complemented by significant investments in rolling stock. As a result, Ireland’s rail network has the youngest intercity fleet in Europe. Service capacity and reliability have also much improved and passenger demand has responded, averaging a 4% per annum growth.

Air Transport

Ireland has four International Airports - Dublin, Shannon, Cork and Belfast and five regional airports and is well serviced by international and regional flights. Ireland has extensive transport links to Europe and the rest of the world including 400 flights a week from Dublin, Cork and Shannon to London. US Pre-Clearance facilities at Dublin Airport and Shannon Airport are the only ones of their kind in Europe. New connections in 2018 include a direct Dublin-Hong Kong flight and additional flights to Canada.

Focus industries

Dublin is a major center for Business Services, Financial & Insurance Services, Engineering, Cleantech, Information Technology, Health & Medical and Life Sciences.

Learn about our Focus industries.